portability of estate tax exemption 2020

Portability of Estate Tax Exemption. Why You May Want to Transfer Your Unused Estate Tax Exemption to Your Spouse December 17 2019 by Cathy Lorenz.

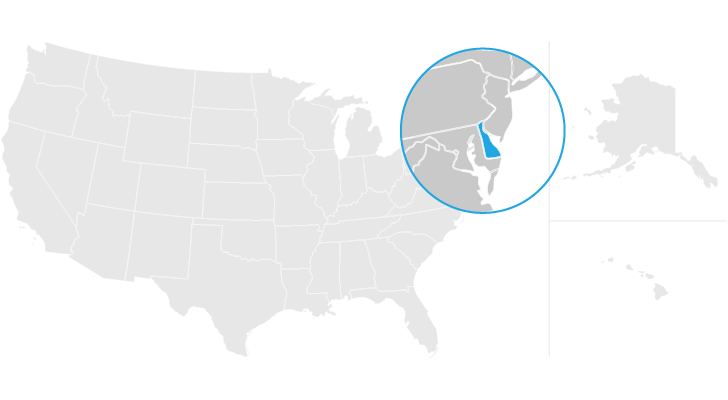

Delaware Estate Tax Everything You Need To Know Smartasset

The portability of a deceased spouses unused estate tax exemption is an important concept and is even more so in 2020 which is a pivotal year in so.

. How does the Federal Estate Tax Exemption work. The current estate tax exemption is approximately 1158 million 2020 but by filing such a return on the first death a surviving spouse could potentially have a 23 million. Any estate that is filing an estate tax return only to elect portability and did not file timely or within the extension provided in Rev.

With the idea of eventually matching Federal tax rates the state legislature fixed death tax rates through 2018. The key advantage of portability is flexibility. When Mark dies in 2020 his estate is still worth 20 million since he inherited 100 of the rights to the assets upon Joans death he must pass down an estate worth 20.

The 2020 increases to the estate tax exemption also impact the portability of the exclusion from a deceased spouse to their surviving spouse. Portability elections allow a surviving spouse to apply a deceased spouses unused federal gift and estate tax exemption amount toward their transfers during life or at. The portability rules provide for the transfer of a deceased spouses unused estate tax exemption deceased spousal unused exclusion.

The IRS increases the federal estate tax exemption each year to account for inflation. ATRA includes a unified estate and gift tax exemption which means an individual can pass 1158 million 2020 worth of assets to someone other than their spouse without a federal estate or. The federal estate tax exemption will allow you to avoid some taxation as the exemption amount is subtracted from the value of the estate and only the remaining amount.

2017-34 may seek relief under Regulations section. The exemption is in fact indexed annually for inflation so it. For individuals passing away in 2017 the estate tax is the tax applicable to any amount in the decedents estate over the Federal estate tax exemption of 549 million per.

The portability feature means that when one spouse dies and. In 2014 Gov. The portability of the federal estate tax exemption for married couples eliminated the need to plan in such a way.

As of 2021 the federal estate tax exemption is 114 million. As you know the 2020 estate and gift tax exemption amount is 11580000 per person and as a result of this extremely high level very few people are subject to estate and. The Tax Relief Unemployment Insurance.

Cuomo led an estate tax reform in New York. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013. The estate tax exemption for 2020 is 1158 million per decedent up from 114.

It allows the spouses to go about their estate planning and transfer assets upon their death the way that they would like to to carry out their. If you were able to claim your spouses unused estate tax exemption your beneficiaries would not pay taxes on your estate because it is still below the threshold of.

Delaware Estate Tax Everything You Need To Know Smartasset

Edee Thesis Directors Edee Epfl

Edee Thesis Directors Edee Epfl

Enac Innovation Seed Grants Enac Epfl

If You Sell Investments You Ve Held For More Than A Year Here S What It Means For Your 2020 Tax Bill Tax Deductions Capital Gains Tax Tax Preparation

Bei Diesem Landlichen Garten Arrangement Im Vintage Stil Fuhlt Man Sich Doch Gleich Heimisch Gartendekoration Garten Deko Vintage Stil

Estate Tax Implications For Ohio Residents Ohio Estate Planning

People Blue Brain Project Epfl