how much is the estate tax in texas

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. But dont forget about federal.

Treasury Department Drops Potentially Costly Estate Tax Proposal Texas Farm Bureau

Among the 3780 estates that owe any tax the effective tax rate that is the percentage of the estates value that is paid in taxes is 166 percent on average.

. See this related post on the differences between inheritance and estate tax. How much is inheritance tax in Texas. The Estate Tax is a tax on your right to transfer property at your death.

This marginal tax rate means that. Your average tax rate is 1198 and your marginal tax rate is 22. Texas Commercial Property Tax Increase Limits.

If you make 70000 a year living in the region of Texas USA you will be taxed 8387. There is a 40 percent. 1 2005 there is no estate tax in Texas.

Most Americans will never have to pay a dime in estate tax because the federal government exempts all estates worth less than roughly 12 million. The portion of the estate thats above this 1170 million limit will ostensibly be taxed at the top federal statutory estate tax rate of 40. Estate and gift taxes the.

The Texas Legislature recently passed a bill that will increase the amount of money commercial property owners have to pay. You also pay 40 of the. Therefore there is no estate limit exemption or tax rates to be concerned about.

The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that. Counties in Texas collect an average of 181 of a propertys assesed fair market. Theres more good news.

As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. Texas has no inheritance tax so any money you receive as. 12000 from the propertys value.

How Much is the Homestead Exemption in. 1 or as soon thereafter as. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. Tax Code Section 3101 requires the assessor to prepare and mail a tax bill to each property owner listed on the tax roll or to that persons agent by Oct. Here are some answers to a few of the most common issues when considering homestead property tax exemptions in Texas.

It is sometimes referred to as a death tax. In practice however various. A disabled veteran may also qualify for an exemption of 12000 of the assessed value of the property if the veteran is age 65 or older.

Statewide the effective property tax is 186 the sixth highest rate in the country. The initial payment for the first 1 million is 345800. How Much is Inheritance Tax in Texas.

The good news is that Texas does not have an estate tax. In Travis County your property taxes on a 250000 home would be 4933 while in Harris. The exact property tax levied depends on the county in Texas the property is located in.

After deducting the 1206 million exemption for 2021 you have a taxable estate of 33 million.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Texas Inheritance Laws What You Should Know Smartasset

Texas Attorney General Opinion Ww 1134 The Portal To Texas History

Texas Retirement Tax Friendliness Smartasset

Texas Estate Tax Planning Boerne Estate Planning Law Firm

9 States With No Income Tax Kiplinger

Texas And Tx State Individual Income Tax Return Information

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

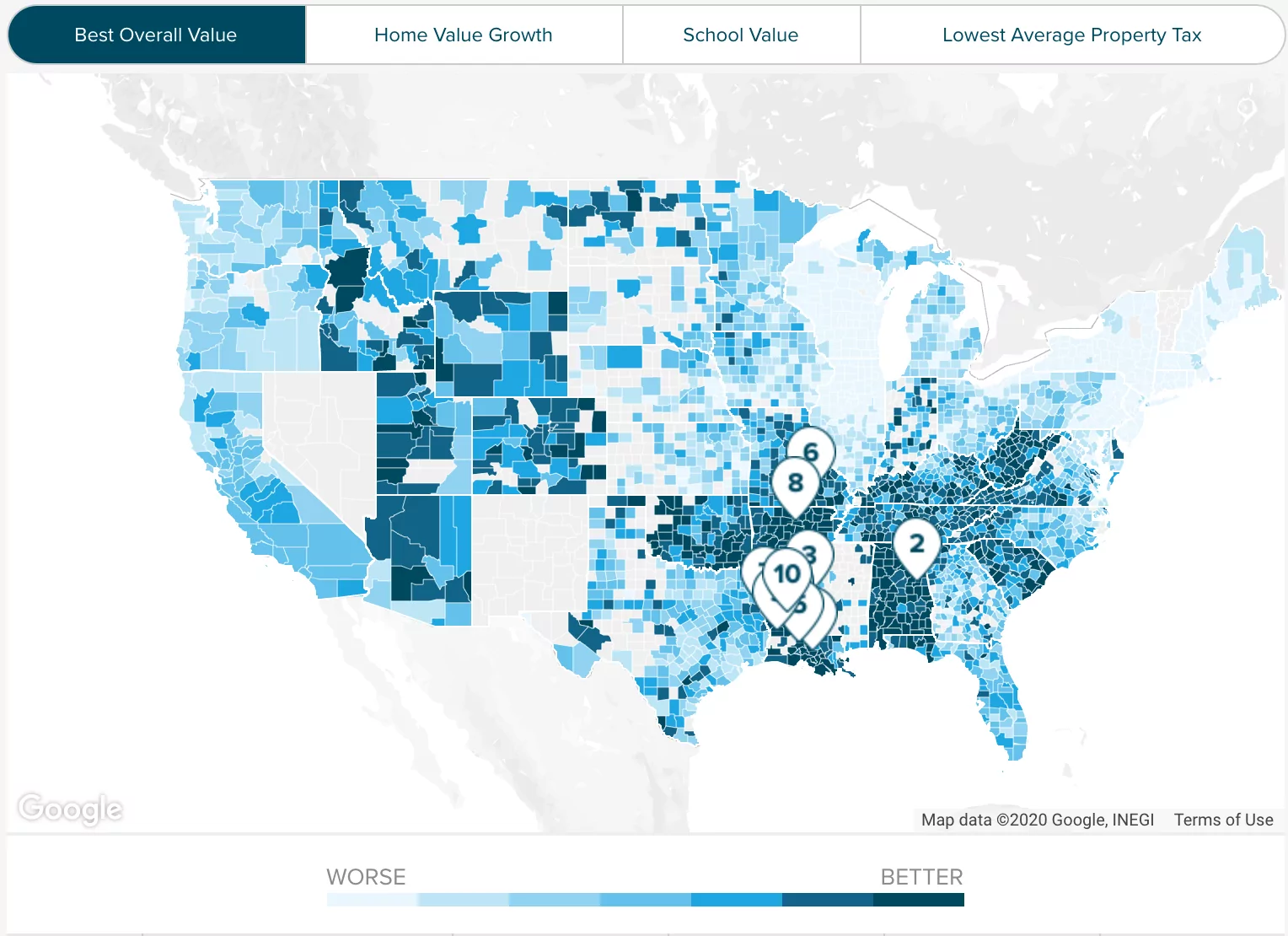

The Estate Tax And Real Estate Eye On Housing

Potential Changes To The Estate Tax Texas Trust Law

Death Tax In Texas Estate Inheritance Tax Law In Tx

Texas Income Tax Calculator Smartasset

Over 65 Property Tax Exemption In Texas

State Estate And Inheritance Taxes Itep

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Texas Has The Fifth Highest Property Taxes In The Nation But Do We Get What We Pay For Candysdirt Com

Harris County Tx Property Tax Calculator Smartasset

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation